In a first-of-its-kind move, the state of Ohio has officially approved the acquisition of Summa Health, a leading nonprofit hospital system, by General Catalyst, a prominent venture capital firm. This landmark deal represents the first-ever venture capital takeover of a U.S. hospital system, signaling a major shift in how health systems may be funded, operated, and scaled in the future.

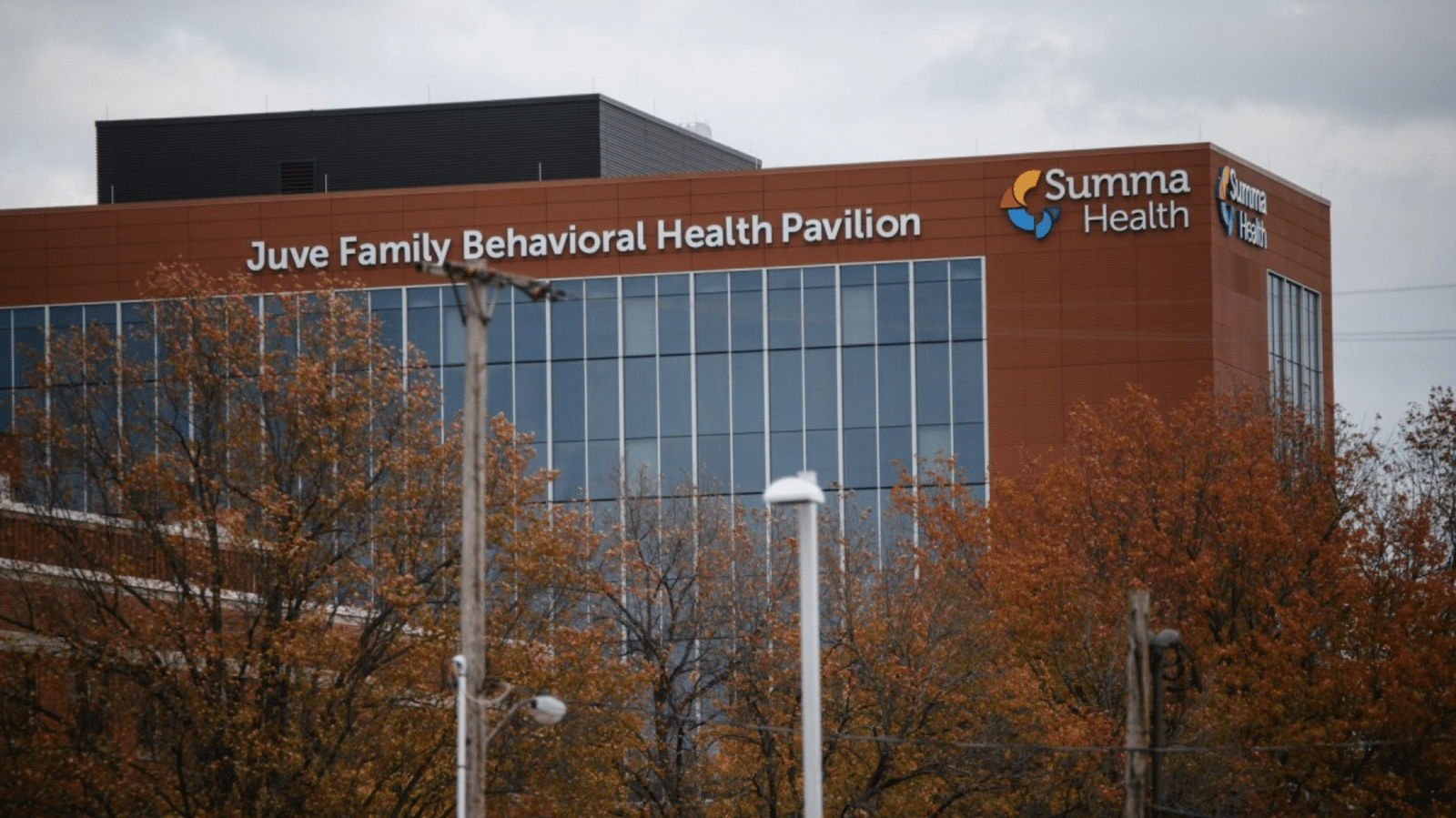

Photo Credit: Doug Brown / Signal Akron

What Is the Summa Health Acquisition About?

General Catalyst, known for its investments in cutting-edge health tech platforms like Olive AI and Transcarent, will acquire full control of Summa Health, based in Akron, Ohio. The deal, valued at over $500 million, has been cleared by the Ohio Attorney General and Department of Health, following a six-month public review.

Terms of the Agreement

- $550 million in capital commitments will be injected into Summa Health over 10 years.

- General Catalyst must maintain key services like emergency care, behavioral health, and charity programs.

- A community oversight board will monitor operations for a decade.

- All Summa assets, including two hospitals and multiple outpatient centers, will be transferred to a for-profit structure.

Why This Acquisition Matters

This deal represents a radical transformation in hospital ownership models. While private equity has previously acquired physician groups and small clinics, this is the first time a major nonprofit hospital system has come under venture capital ownership.

Supporters argue it will bring:

- Tech-driven innovation in care delivery

- Faster digital transformation

- Access to scalable capital for underserved health systems

Critics, however, fear:

- Potential cost-cutting at the expense of patient care

- Erosion of community trust in formerly nonprofit institutions

- Prioritization of ROI over long-term healthcare outcomes

The Bigger Picture: VC in Healthcare Delivery

General Catalyst has publicly stated its ambition to build a “healthcare platform company” by acquiring and modernizing care delivery systems. The firm views healthcare as a “broken system” ripe for tech-led reform.

Summa Health is now expected to become the anchor institution in this new model—potentially setting a national precedent for how hospitals partner with private capital to remain competitive in a post-pandemic world.

“This isn’t just about buying a hospital—it’s about reimagining care at scale,” said General Catalyst’s managing director, Chris Bischoff.

Key Takeaways:

- Ohio approved the first-ever VC acquisition of a U.S. hospital, involving Summa Health and General Catalyst.

- The $500M+ deal includes $550M in reinvestment and 10 years of regulatory oversight.

- This could mark the start of a new era in hospital funding and management, blending capital with technology to modernize care.

Source: Wall Street Journal – Ohio Greenlights First-Ever Venture Capital Hospital Acquisition